It’s been a tough season for some of tech’s biggest names, but Nvidia? Nvidia is on fire. While most of the Magnificent Seven look like they’re stuck in second gear, Nvidia keeps sprinting ahead — powered by AI demand, custom hardware dominance, and some very smart bets that are paying off big.

The S&P 500 and Nasdaq may still be riding high, but under the hood, cracks are showing. Apple, Amazon, Alphabet, Microsoft, Meta, and Tesla all face headwinds, from regulatory headaches to executive drama. But Nvidia’s growth story? It’s just getting started.

The Rest of the Pack Is Slowing Down

These tech giants once moved in near-lockstep, carrying indexes on their backs. Not anymore. The divergence is real.

Apple’s whole ecosystem still revolves around one thing — the iPhone. It’s the golden goose, but it’s also become a ball and chain. Trade wars, tariffs, competition from Huawei, and supply bottlenecks have squeezed margins and expectations. No new product has come close to dethroning the iPhone at the top of Apple’s earnings report.

Amazon? It’s feeling the squeeze too. A flood of low-cost cross-border sellers has swamped its marketplace. Meanwhile, costs from logistics to labor keep rising. It’s still big, still profitable, but the easy growth days are behind it.

Alphabet has bigger problems. Google Search is losing its shine as people shift to AI tools like ChatGPT. And regulators in the U.S. and Europe aren’t playing nice anymore.

Then there’s Microsoft, which is now tangled in a strange public fallout with OpenAI. Once partners, now it looks more like an awkward corporate standoff. And Tesla — well, Elon Musk continues to do Elon Musk things. While his die-hard fans stick around, many mainstream consumers are getting cold feet. It doesn’t help that the EV market is getting awfully crowded.

Meta Is Holding Steady — For Now

Meta isn’t falling apart, but it’s not coasting either. Ad revenue still pays the bills — and it pays them well. In fact, more than 97% of its income still comes from advertising.

There’s a catch though. Ads rely on economic stability. As inflation pressures consumers and businesses pull back on marketing budgets, Meta’s core business starts to wobble.

Still, Meta’s Reality Labs are showing flashes of long-term promise. But those returns are years out. Right now, Wall Street wants predictable revenue — and that’s getting harder to deliver.

It’s walking a fine line between stability and stagnation.

Nvidia’s AI Boom Isn’t Slowing Down

Now here’s where it gets interesting.

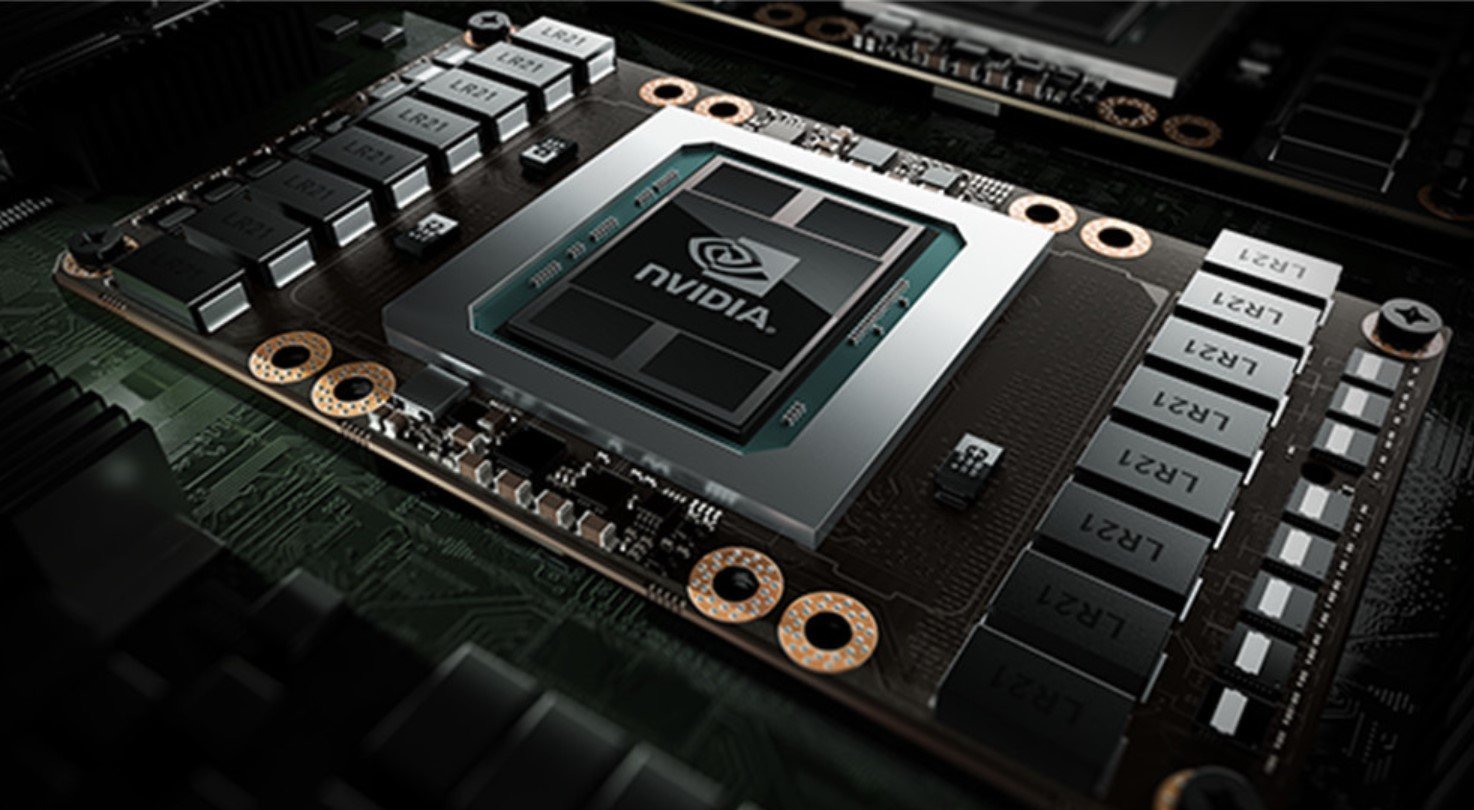

Nvidia’s rise isn’t just about tech hype. It’s about selling the actual tools companies need to build AI systems. It’s selling the picks and shovels in a digital gold rush — and business is booming.

Less than a decade ago, Nvidia’s bread and butter was gaming GPUs. These days? Not even close.

-

In fiscal 2025, data center GPUs made up 88% of Nvidia’s revenue.

-

Gaming GPUs? Just 9% — a massive drop from previous years.

Here’s how Nvidia’s data center business exploded:

| Fiscal Year | Data Center Revenue Growth | Data Center % of Total Revenue |

|---|---|---|

| 2022 | 58% | 39% |

| 2023 | 41% | 56% |

| 2024 | 217% | 78% |

| 2025 | 142% | 88% |

Those aren’t just good numbers. They’re historic.

And it’s not slowing down. Analysts expect Nvidia’s revenue and earnings per share to grow around 30% annually through 2028.

One Moat to Rule Them All

So why can’t anyone else just do what Nvidia does? Turns out, it’s not so easy.

It starts with CUDA — Nvidia’s custom software platform. Developers who build AI applications using CUDA are locked in. If they want to switch to AMD or someone else? They’d have to rewrite their entire application codebase. That’s a massive barrier.

This software-hardware symbiosis is Nvidia’s secret sauce. And it’s why even with the rise of challengers like AMD or Google’s TPU chips, Nvidia keeps dominating.

There’s also this — TechInsights says Nvidia owns 98% of the data center GPU market. That’s not a typo.

Even U.S.-China Tensions Can’t Slow It Down Much

Export restrictions to China? Yes, they hurt. But not as much as you’d think.

Nvidia’s already shipping custom “H20” chips that meet U.S. rules but still satisfy Chinese demand. Meanwhile, its Western business is growing fast enough to absorb the hit.

And remember, Nvidia doesn’t own factories. It’s a fabless chipmaker, relying on Taiwan Semiconductor for production. That keeps its capital costs lower and lets it move faster than rivals.

So even if geopolitics gets messy, Nvidia still has room to maneuver.

Wall Street Is Catching On — But Not Fast Enough

Despite blowing past earnings expectations for nine straight quarters, Nvidia’s valuation isn’t as frothy as you’d expect. It trades around 36 times forward earnings, which — considering its growth rate — isn’t insane.

In fact, some analysts say that’s a steal. Others still seem to underestimate just how sticky and essential Nvidia’s business has become in this AI race.

Wall Street might be cautious, but Nvidia’s customers aren’t.

Demand is high. Supply is tight. And the AI buildout across cloud providers, enterprises, and startups is just getting warmed up.