Electric air taxis finally seem ready to take off, but their stocks just hit a rough patch. Joby Aviation and Archer Aviation, the top players in this buzzing field, saw shares drop sharply last month. This dip could be a smart entry for bold investors who can wait out the bumps. What makes these companies worth watching as they push toward real flights in cities?

Joby Aviation Leads the Certification Race

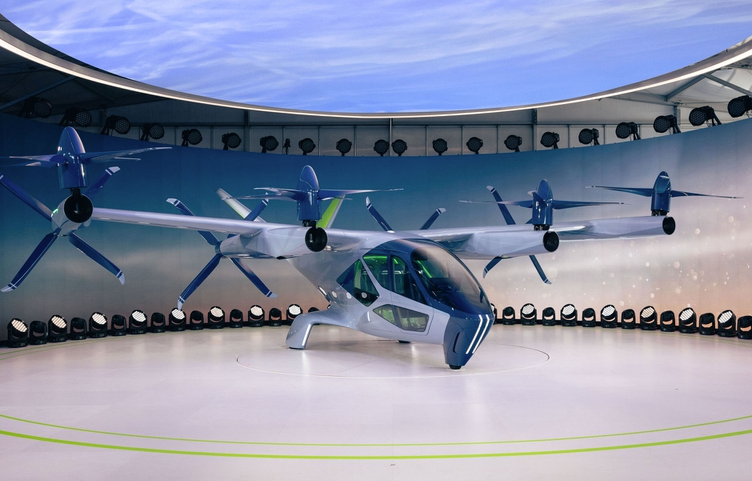

Joby Aviation stands out as the top dog in getting electric vertical takeoff and landing aircraft approved. The company just started power-on tests on its first full-size plane that meets all rules. Experts say Federal Aviation Administration pilots could fly it early next year. That step puts Joby on a fast track to start paid rides in 2026.

Joby has flown over 600 times this year alone, proving its tech works in real spots. They ran demo flights for two weeks straight at the World Expo in Osaka, Japan. This shows the planes can handle busy schedules without a hitch.

The firm also locked in a big deal last month. They signed to sell up to $250 million worth of planes and services in Kazakhstan. That move hints at growing interest from places outside the US, even before full approval comes.

Joby pulls in big backers that boost its odds. Toyota poured in almost $900 million and helps ramp up factory work. Nvidia teams up on self-flying systems with its top tech. Uber stays close after selling its own air taxi work to Joby years back.

One bump hit recently. Joby sued rival Archer on November 19 for stealing trade secrets. The case claims Archer grabbed private info during a short team-up. Archer fights back, saying the claims lack proof. This fight adds drama but does not slow Joby’s main push.

Archer Builds Out Air Taxi Hubs

Archer Aviation takes a hands-on path by not just making planes but setting up the spots where they land. They focus on short city hops to ease traffic jams. Last month, Archer bought Hawthorne Airport near Los Angeles for $126 million. This spot sits just three miles from the main airport and near big events like SoFi Stadium.

With the 2028 Olympics headed to LA, Archer eyes a role in quick rides for crowds. The company holds over $2 billion in cash, giving it years to grow without stress. That strong wallet lets them chase big plans without rushing deals.

Archer teams with heavy hitters too. Stellantis handles building the planes at scale. United Airlines agreed to buy a bunch for its routes. Deals in Asia and the Middle East open doors for global sales.

Wall Street pros stay upbeat on Archer. They set a middle price goal at $12.40 per share. That points to about 70 percent growth from today’s level around $7.50 as of November 26. Investor Cathie Wood’s Ark Invest bought more shares during the drop. Her move signals faith in the rebound.

Archer also inked a fresh pact on November 19. They link with Saudi Arabia’s Helicopter Company and Red Sea Global to start air taxis at resorts by 2026. Flight tests there could follow soon. This expands Archer’s reach into hot markets.

Why eVTOL Stocks Faced a Sharp Sell-Off

Shares in electric air taxi firms tumbled hard in recent weeks. Joby’s stock fell about 35 percent from its top of nearly $21 this year. It trades at $14.12 now, with a company value of $13 billion. Archer dropped 34 percent to $7.50, worth $5 billion overall.

Investors got jittery over slow progress and high costs. Both firms burn cash fast with no big sales yet. Rules from the government drag on, and building factories takes time. A wider market dip in growth stocks added pressure too.

The lawsuit between Joby and Archer stirred more worry. It highlights cutthroat fights in this young field. Some fear delays from legal battles or bad press.

Yet data shows the sector grows fast. A report from last year predicts urban air rides could hit billions by decade’s end. Joby and Archer lead with real tests and deals. Their pullback looks overdone to many watchers.

Here’s a quick look at key stats for both:

| Metric | Joby Aviation | Archer Aviation |

|---|---|---|

| Current Price (Nov 26, 2025) | $14.12 | $7.50 |

| Market Cap | $13B | $5B |

| 52-Week High | $20.95 | $14.62 |

| Recent Drop | 35% | 34% |

| Cash on Hand | $1B+ | $2B+ |

| Target Launch Year | 2026 | 2026 |

This table highlights why both stay in the game despite the hits.

The Big Picture for Patient Investors

Electric air taxis promise to change how we zip around cities. No more gridlock on roads; think quick hops over traffic. Joby and Archer sit at the front with tech that flies clean on batteries. They cut noise and fuel use compared to old choppers.

Risks loom large though. Delays in rules could push back starts. Making planes at low cost proves tough. People might shy away if rides cost too much at first.

But upsides shine bright. Partnerships with giants like Toyota and United build trust. International deals in Dubai and Saudi show global hunger. By 2030, this market could top $40 billion if growth holds at 37 percent a year. Early backers stand to gain big as flights become normal.

Both companies hit key goals this year. Joby’s Osaka demos and Archer’s airport buy prove they move forward. The sell-off creates a chance for those who see the long road.

Investors should weigh their own risks. These stocks swing wild in the short run. But for folks okay with ups and downs, the future looks electric.

The race to everyday air taxis heats up with Joby and Archer leading the charge through tough times. Their recent stock dips mask real steps toward changing travel forever. It stirs hope for quicker commutes and cleaner skies, but reminds us innovation demands patience. What do you think: is now the time to jump in on these eVTOL pioneers? Share your views and spread this story to friends on social media to spark the conversation.