Archer Aviation is still flying under the radar for most investors, mostly because it’s a start-up with no revenue or profits yet. But if 2025 turns out like many expect, this electric air taxi company could be gearing up for a breakthrough moment.

Here’s why the stock’s $13.30 peak matters and what you need to watch in the coming year.

What Exactly is Archer Aviation Building?

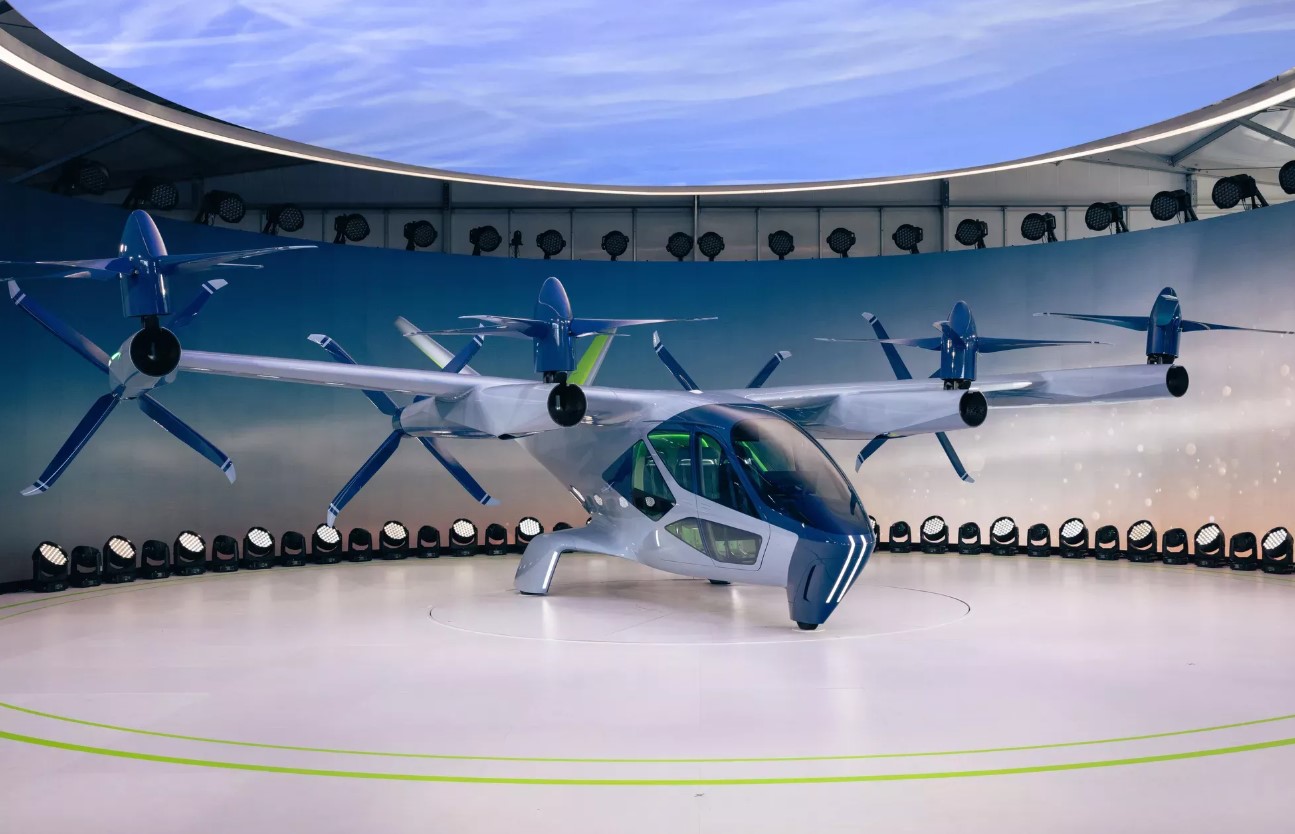

Archer Aviation’s main product is an electric vertical takeoff and landing (eVTOL) aircraft called Midnight. Think of it like a flying taxi, designed for short trips over urban areas. The idea sounds futuristic, but Archer’s already developed a working prototype.

The tricky part? Getting the FAA’s stamp of approval. This isn’t just a quick sign-off—it’s a multi-year, multi-step process, with a whole lot of red tape. At the end of Q1 2025, Archer was only about 15% through this process. That’s a long haul ahead.

But here’s the catch: FAA approval is for the U.S., and that’s just one piece of the puzzle. Midnight could potentially start flying commercially elsewhere first—like Abu Dhabi, for example.

The airline business isn’t just about building cool planes; it’s about proving they’re safe enough to trust. And that takes time, patience, and a whole lot of regulation.

Eyes on Abu Dhabi: Archer’s First Commercial Test

Abu Dhabi is where Archer’s real challenge begins in 2025. They’re working with a local partner to launch the first-ever commercial air taxi service using the Midnight eVTOL. If it happens, it would be the first proof that this concept can work outside the lab.

Getting to that point isn’t simple:

-

Build and deliver the aircraft

-

Train pilots to fly this new type of plane

-

Get regulatory green lights locally

-

Actually carry paying passengers safely

If all these boxes get ticked, investors could see Archer’s story turn into something tangible. The stock could easily zoom past its 52-week high of $13.30 per share when the first commercial flights take off. This isn’t pie-in-the-sky stuff; it’s a real milestone.

What Makes Archer’s Business Model Stand Out?

Archer Aviation isn’t just selling planes; it wants to run the air taxi service itself. That’s a different twist compared to traditional plane manufacturers.

Currently, Archer has:

-

FAA approval to operate as an airline

-

FAA approval to train pilots on Midnight

-

Partnerships lined up in places like California and New York for future air taxi operations

This shows Archer’s planning to hit the ground running in the U.S. once it gets FAA clearance to fly Midnight domestically.

A successful launch in Abu Dhabi could:

-

Show investors that Archer’s longer-term vision is achievable

-

Provide a roadmap for scaling up in the U.S.

-

Build customer trust for flying in eVTOL aircraft

Here’s a quick look at some key stats about Archer’s stock and market position:

| Metric | Value |

|---|---|

| Market Cap | $6 Billion |

| Current Price | $10.08 (as of May) |

| 52-Week Range | $2.82 – $13.92 |

| Average Volume | ~27 million shares |

| Revenue | $0 |

| Dividend Yield | N/A |

The zero revenue part might scare off many, but that’s typical for companies at this stage. The big question is whether the risk will pay off soon.

Should Investors Take a Shot on Archer?

Here’s where it gets personal. Archer Aviation is definitely not for the faint-hearted. No revenue, no profits, and a product that’s not yet fully tested or approved means the risk is sky-high.

But for those who like to gamble on early-stage tech with high upside potential, Archer could be a rare opportunity.

Think about it: a successful air taxi launch in Abu Dhabi might be the spark that sends Archer stock flying past $13.30 again. Investors who jump in now might get in just before the big move.

Still, caution is key. If you’re not comfortable with volatility or losing your whole investment, sitting on the sidelines might be wiser.

So, who’s it for?

-

Investors comfortable with start-up risk

-

Those who believe in electric aviation’s future

-

People ready to hold through bumps and dips

Basically, Archer’s a long shot, but with a shot worth watching.