In recent years, Latin American countries have increasingly turned to China for financial support, particularly through loans from the China Development Bank (CDB) and the Export-Import Bank of China (CHEXIM). These loans have significantly impacted the region’s energy, infrastructure, and mining sectors. This trend is driven by both pragmatic project-level benefits and broader political considerations. Countries with leftist governments and those less aligned with U.S. foreign policy are more likely to seek Chinese financing. This article explores the political and economic factors influencing this shift.

Political Motivations for Borrowing from China

Latin American countries have diverse political landscapes that significantly influence their borrowing decisions. Governments with leftist ideologies often prefer Chinese loans due to fewer political strings attached compared to Western financial institutions. For instance, during Rafael Correa’s presidency, Ecuador borrowed over $10 billion from China, reflecting a strategic alignment with China’s development goals. This trend is not isolated; other countries with similar political leanings have followed suit, seeking to leverage Chinese financing for large-scale infrastructure projects.

The alignment with China’s political and economic model offers an alternative to the traditional Western-dominated financial systems. This shift is partly driven by a desire to reduce dependency on Western institutions like the World Bank and the International Monetary Fund, which often impose stringent conditions on their loans. By contrast, Chinese loans are perceived as more flexible and aligned with the borrowing countries’ development priorities.

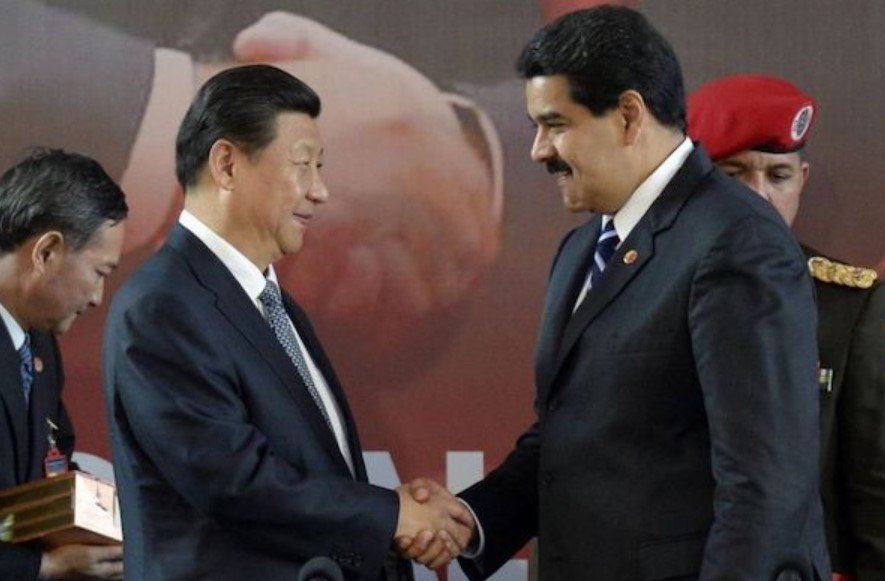

Moreover, the geopolitical landscape plays a crucial role. Countries that are less aligned with U.S. foreign policy, as evidenced by their voting patterns at the United Nations, are more inclined to borrow from China. This alignment with China is seen as a strategic move to balance global power dynamics and assert greater autonomy in international affairs.

Economic Benefits of Chinese Loans

The economic rationale behind borrowing from China is compelling for many Latin American countries. Chinese loans are often directed towards critical sectors such as energy, infrastructure, and mining, which are pivotal for economic development. These sectors require substantial investment, and Chinese financial institutions are willing to provide the necessary capital without the stringent conditions typically imposed by Western lenders.

For example, Chinese loans have funded numerous infrastructure projects across the region, from highways and railways to energy plants and mining operations. These projects not only boost economic growth but also create jobs and improve local infrastructure. The long-term benefits of such investments are significant, contributing to the overall development and modernization of the borrowing countries.

Additionally, Chinese financing often comes with favorable terms, including lower interest rates and longer repayment periods. This makes it an attractive option for countries with limited access to international capital markets or those facing economic challenges. The flexibility and scale of Chinese loans provide a viable alternative to traditional financing sources, enabling countries to pursue ambitious development projects.

Challenges and Criticisms

Despite the benefits, borrowing from China is not without its challenges and criticisms. One major concern is the potential for debt dependency. As countries accumulate significant debt to China, they risk becoming overly reliant on Chinese financing, which could limit their economic sovereignty. This dependency can also lead to unfavorable terms in future negotiations, as borrowing countries may have limited leverage.

Furthermore, there are concerns about the transparency and accountability of Chinese loans. Unlike Western financial institutions, which often require rigorous oversight and adherence to international standards, Chinese loans may lack the same level of scrutiny. This can lead to issues such as corruption, mismanagement, and environmental degradation, as projects funded by Chinese loans may not always adhere to best practices.

Another criticism is the geopolitical implications of Chinese loans. As China expands its influence in Latin America, there are fears that this could undermine the region’s political stability and sovereignty. Critics argue that Chinese loans are a tool for expanding China’s geopolitical reach, potentially at the expense of the borrowing countries’ long-term interests.